How to Budget Fund Balance

How to Budget Prior Year Fund Balance in 3 Steps

Step 1

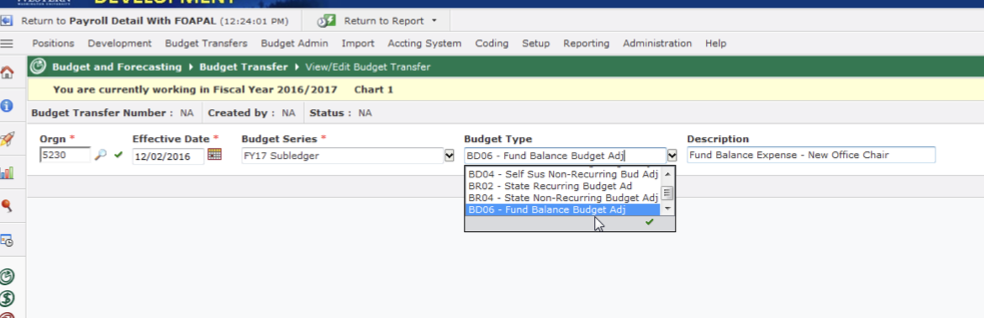

Perform a budget transfer to increase expense budget in the FOAPAL with the fund balance using Budget Type BD06 (Fund Balance Budget Adj).

Use the same account code where you intend to expend the funds from in the year. For example, if you are buying a new office chair, you might use E111. If you’re transferring lump sum departmental support, use K115. The fund balance total you plan to use will be reflected in the YTD Budget column as a negative net change amount. This will indicate that you plan to spend that amount over your regular budget and will be using your fund balance to cover the expense.

Note: this will be the only time that you will be permitted to do a non-balanced (i.e. “one sided”) transaction for state funds. The BD06 budget type code is only for fund balance budgeting.

Example

Select BD06 and save header and then enter detail:

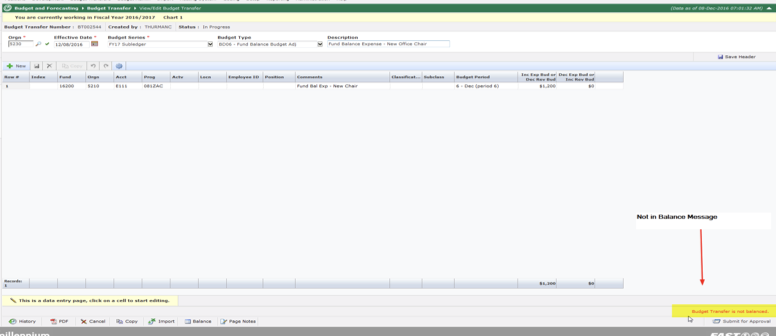

Enter detail and submit. Notice the not in balance warning at the bottom of the page:

Step 2

Proceed to next step depending on type of transaction you would like to perform. What would you like to do?

A. Expend From Your Own FOAPAL

If you chose this option, there is no need to perform any more transfers. You will just plan to spend that amount over your total budget for the fiscal year in the same FOAPAL combination as the BD06 budget transfer in Step #1. The fund balance total you plan to use will be reflected in the YTD Budget column as a negative amount. This will indicate that you plan to spend that amount over your regular budget and will be using your fund balance to cover the expense.

OR

B. Transfer Lump Sum Amounts to Other FOAPALS (Department Support)

Once your BD06 budget transfer is complete using account code K115, create an accounting Journal Voucher using the K114 (credit) /K115 (debit) account codes. This will allow you to transfer a lump sum credit without needing to reimburse a specific account code.

You can only use K114 / K115 within fund types. For example – transactions between two state funds are acceptable but not between a state fund and a self-sustaining fund.

K114: Fund balance transfer in

K115: Fund balance transfer out

OR

C. Reimburse a Specific Expense in Another FOAPAL – State, Self-Sustaining or a Combination of Both

If you plan to reimburse another FOAPAL/department for a specific item using your fund balance, wait until the department makes the purchase so that you know the total to transfer. Once you know the amount you are going to reimburse, create the BD06 budget transfer using the same account code of the item expended. Next, you will submit an accounting journal voucher to debit your FOAPAL and credit the other department’s FOAPAL using the same account code as the expense and the BD06 budget transfer. This will reimburse the department and move the expense to your FOAPAL. This type of transfer may be used across fund types.

Step 3

Verify that all fund balance funds have been spent according to plan once all transactions are complete for the fiscal year.

For assistance with fund balances please email SMB@wwu.edu.